Charitable Contributions Subject To 10 Floor

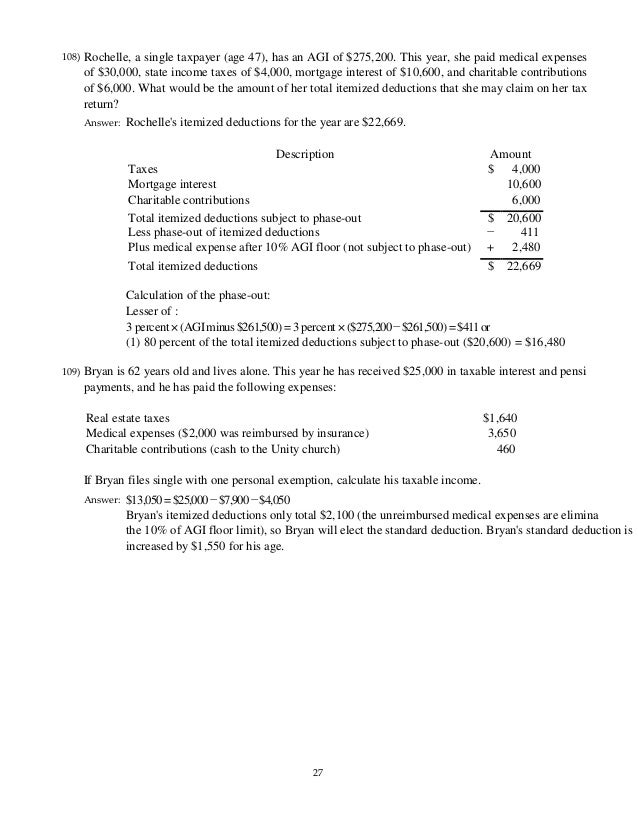

Under the tcja the annual charitable deduction by a corporation is generally limited to 10 of taxable income while a 15 limit applies to charitable contributions of food.

Charitable contributions subject to 10 floor. Casualty loss before 10 limitation after 100 floor. Unreimbursed employee expenses subject to the 2 of agi limitation. Allowance of partial above the line charitable contributions. The cares act increase these amounts to 25 of taxable income for 2020.

Qualified contributions are not subject to this limitation. The 100 of agi contribution limit applies only to gifts of cash directly to charities not including family funded private foundations. 14 noncash contributions subject to the limit based on 50 of agi. Enter the smaller of line 10 or line 12.

One of the major deviations that sets trusts apart from individuals is the applicability of deductions for charitable contributions. The charitable deduction limitation for cash contributions to certain public charities and private foundations is increased to 60 from 50 of an individual s agi for the year. Enter the smaller of line 10 or line 12 13 14. Trusts have the same limitations for investment interest expenses can take real estate tax deductions and have separate deductible items subject to the 2 floor.

Subtract line 13 from line 10. 14 noncash contributions subject to the limit based on 50 of agi. Multiply line 11 by 0 6. The cares act allows individuals who do not elect to itemize their deductions to take up to a 300 above the line deduction in arriving at.

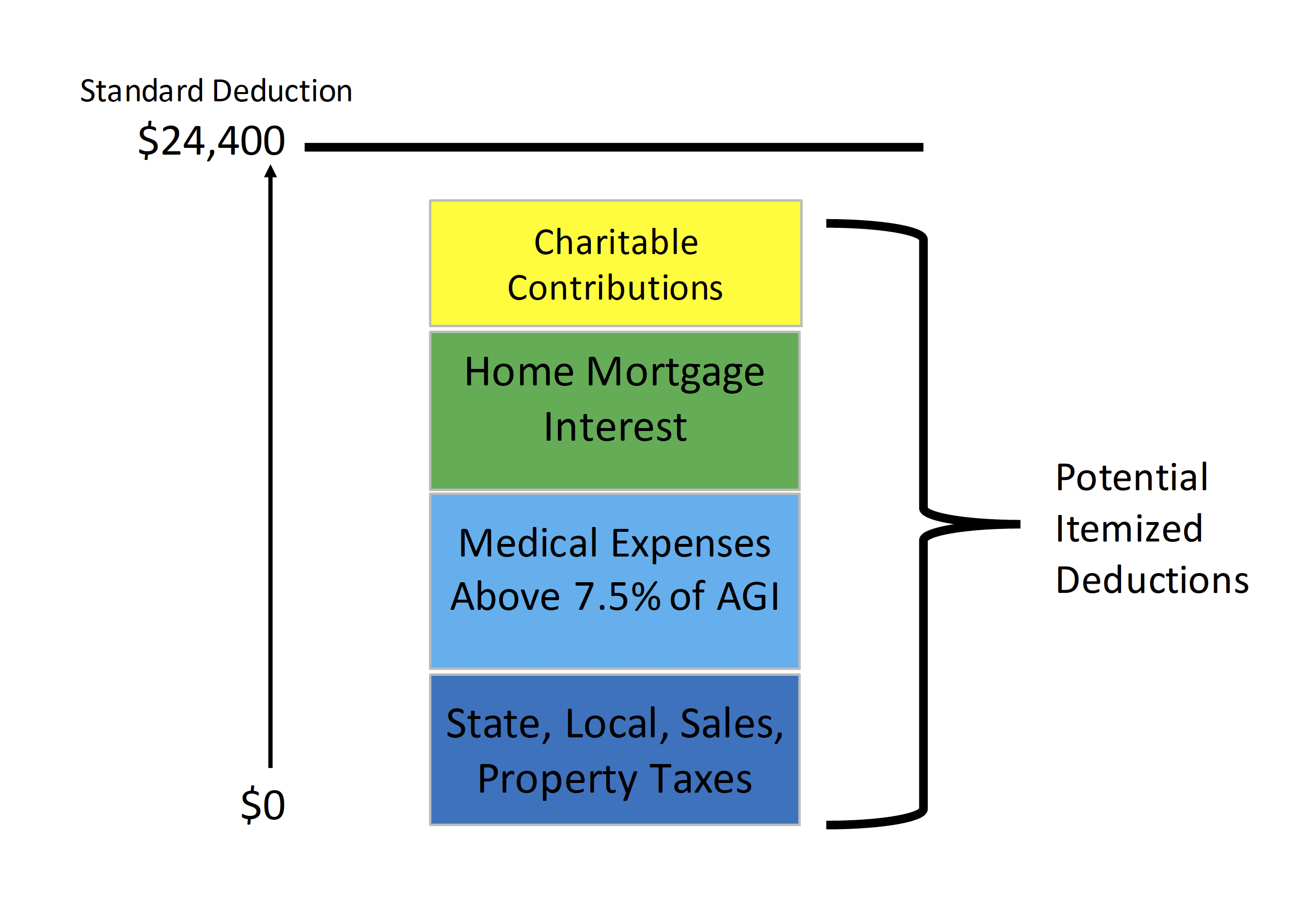

Temporary suspension of limits on charitable contributions in most cases the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income agi. Not in a federally declared disaster area 19 000. Cash contributions subject to the limit based on 60 of agi if line 10 is zero enter 0 on lines 12 through 14 12. Donations in excess of 25 may be deducted in the following five years.

Cash contributions subject to the limit based on 60 of agi if line 10 is zero enter 0 on lines 12 through 14 12. Contributions made to a non operating private foundation or a donor advised fund daf do not qualify as qualified charitable contributions. Charitable giving paper message on assorted cash. Multiply line 11 by 0 6.